mchenry county illinois property tax due dates 2021

Pay in person at. The due dates for both installments is october 15 2021.

Big List Of Aug 3 National Night Out Events In Kane County Il Kane County Connects

Real Estate 2nd Installment Due Date September 6 2022 Interest Penalty imposed on payments madepostmarked after September 6.

. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax. 47 and Russell Ct with drive-thru service and 24-hr. 173 of home value.

An a symbol means the state has an amazon fulfillment center. 09 - 10 - McHenry. 47 and Russell Ct with drive-thru service and 24-hr.

For your convenience payments may be mailed directly to PO Box 689 Morris or made in person at the courthouse located at 111 E. Learn all about McHenry County real estate tax. Electronic check payments E-Checks have a flat fee depending on the payment amount.

McHenry Township Assessor Mary Mahady CIAO 3703 N. McHenry County collects very high property taxes and is among the top 25 of counties in the United States. McHenry County collects on average 209 of a propertys assessed fair market value as property tax.

Visa Debit card 395 flat fee. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. Property Tax Relief 2021 Distributed as a public service for property owners by.

See Results in Minutes. Ad Download Property Records from the McHenry County Assessors Records. Look Up Any Address in McHenry County for a Records Report.

Taxing districts confirm final tax rates and extensions which the County Clerks Office then certifies to the Treasurers Office for billing. No personal checks or postmarks accepted. Property tax bills mailed.

Using a credit card or direct withdrawal on our website. Whether you are already a resident or just considering moving to McHenry County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Richmond Road Johnsburg IL 60051 8153850175 8153225150 Fax Website.

Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year. Fees apply Pay by phone. 2020 Taxes Due 2021.

Drop box service available. Remember to have your propertys Tax ID Number or Parcel Number available when you call. You will need to use Jurisdiction Code 2301.

Located at the southeast corner of Rt. 672022 2nd Installment Due. The median property tax also known as real estate tax in McHenry County is 522600 per year based on a median home value of 24970000 and a median effective property tax rate of 209 of property value.

Real Estate 1st Installment Due Date June 6 2022 Interest Penalty imposed on payments madepostmarked after June 6. If you have not received your tax bill please verify your. To search for tax information you may search by the 10 digit parcel number last name of property owner or site address.

Grundy County Collector has mailed mobile home tax bills with payment due date of June 1 2021. The phone number should be listed in your local phone book under Government County Assessors Office or by searching online. Pay in person at.

If you have documents to send you can fax them to the. McHenry County Property Tax Inquiry. Real Estate Taxes due dates are as close to June 1st and.

September 15 2021. Welcome to ford county illinois. Drop box service available.

When searching choose only one of the listed criteria. Illinois Route 47 Morris IL 60450. Tax amount varies by county.

In Cook County the first installment is due by March 1. Sign up for property tax reminders by email or text. Do not enter information in all the fields.

Contact your county treasurer for payment due dates. In most counties property taxes are paid in two installments usually June 1 and September 1. Last day to submit changes for ACH withdrawals for.

Credit card payments carry a 235 convenience fee. McHenry County has one of the highest median property taxes in the United. The original due date to file and pay Illinois individual income tax for calendar year filers is April 18 2022.

Tax bills are mailed. 2021 Real Estate Tax Calendar payable in 2022 May 2nd. Yearly median tax in McHenry County.

Tax bills are scheduled to be mailed out May 7 with installment due dates set for June 7 and Sept. The median property tax in McHenry County Illinois is 5226 per year for a home worth the median value of 249700. Illinois taxes due date 2021.

McHenry County Treasurer Office. Located at the southeast corner of Rt. Payments can be made by phone at 1-877-690-3729.

You can call the McHenry County Tax Assessors Office for assistance at 815-334-4290. Using a credit card or direct withdrawal on our website. Illinois property tax due dates 2021.

McHenry County Treasurer Office. For example if you were formed on july 15 2020 your annual report is due july. All other debit cards have a 235 convenience fee.

Mobile Home Due Date. Fees apply Pay by phone. Delinquent tax sale december 7 2021.

209 of home value. Delinquent taxes sold at tax sale.

2015 Bentley Flying Spur V8 Bentley Flying Spur Bentley Flying Spur

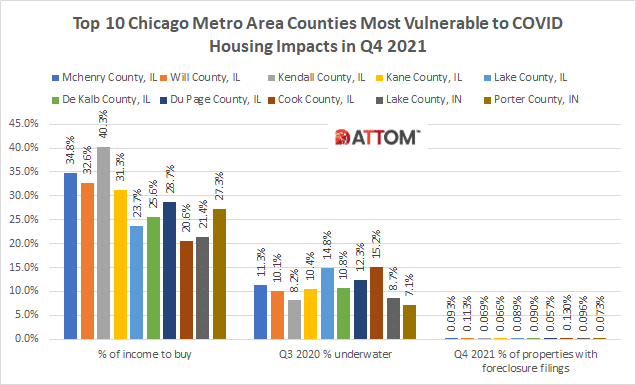

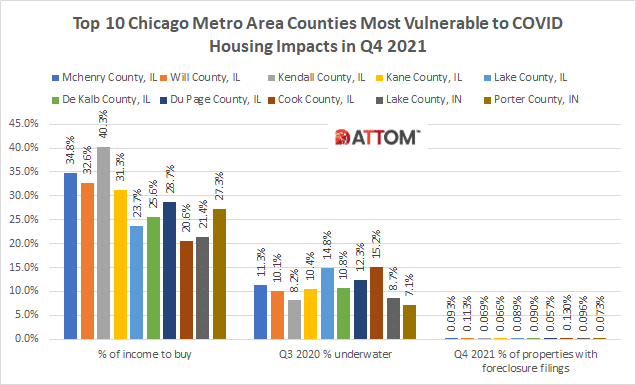

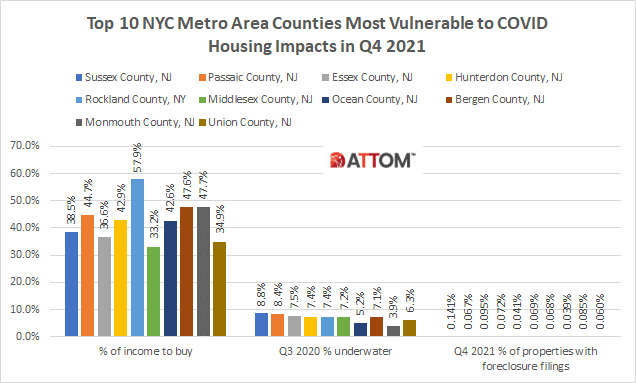

Top Impacted Housing Markets Vulnerable To Covid Impacts Attom

The Brand Startup On Instagram If You Want To Learn More About This Tax Hack Check Out Cofield Advisor And Click The Link In His Bio For A Free Copy Of His

Top Impacted Housing Markets Vulnerable To Covid Impacts Attom

Illinois Homes Sold Fast In January As Demand Remains High Illinois Realtors

Illinois Homes Sold Fast In January As Demand Remains High Illinois Realtors

Big List Of Aug 3 National Night Out Events In Kane County Il Kane County Connects

The Top 4 Big Modular Seating Series By Missoni Home Shown Here Individual Elements Upholstered Interior Design Armless Lounge Chair Modern Furniture Stores

2660 Regner Rd Mchenry Il 60051 6 Beds 5 Baths Mchenry Waterfront Homes House Styles

Engage Inspire Empower Day Of Remembrance Ceremony At Country Trails Elementary School Elementary Schools Elementary Ceremony